‘There are many precedents for politically driven, discretionary special packages’

| Photo Credit: Getty Images

Andhra Pradesh is in deep financial distress and there is a strong case for the Finance Commission to make a special dispensation for the State.

When Telangana was carved out of the larger State of Andhra Pradesh in 2014, the rump State of Andhra Pradesh demanded that it be given a ‘special category’ status to cope with the loss of Hyderabad, the dominant tax generator of the combined State. Even though then Prime Minister Manmohan Singh gave an assurance on the floor of Parliament conceding this demand, the Act dividing the State did not make any provision for a special category status.

The division of the State took effect in June 2014, a time when the National Democratic Alliance government had replaced the United Progressive Alliance government at the Centre; N. Chandrababu Naidu became the first Chief Minister of the rump State of Andhra Pradesh. All through his term (2014-19), Mr. Naidu fought energetically for the parliamentary assurance to be honoured but the Narendra Modi government stonewalled the plea on the ground that the Centre had discontinued the ‘special category’ scheme on the advice of the 14th Finance Commission.

Mr. Naidu, who returned as the Chief Minister in 2024 is staring at near empty coffers after the blows of structural fiscal handicaps and the pressure of funding unaffordable freebies under the preceding Y.S. Jagan Mohan Reddy government (which he topped up handsomely in his own campaign). Competitive freebies under electoral pressures are a State-level issue and the Centre is under no obligation to come to the State’s aid. But the Centre has a definite obligation to compensate Andhra Pradesh for the structural fiscal losses it suffered on account of the bifurcation of the State.

An option

A straightforward option is for the Centre to make an exception and accord ‘special category’ status to Andhra Pradesh on the ground that it is only fulfilling an assurance given in Parliament. But for Andhra Pradesh itself, this may not be an attractive choice because the ‘special category status’ has been watered down. Unlike before, when a special category State received substantial fiscal support through Plan assistance, all that it now gets is external loans such as those from the World Bank on slightly softer terms. Such a diluted ‘special category status’ will be a hollow victory for Andhra Pradesh.

A better option for Andhra Pradesh is to seek a special package of assistance that is more generous than a straitjacketed special category status. There are many precedents for politically driven, discretionary special packages such as the Koraput-Balangir-Kalahandi special plan for Odisha and the Bundelkhand special package for Madhya Pradesh and Uttar Pradesh. Bihar was also given a special ‘pre-election’ package in 2015. However, such ‘one off’ packages on political and discretionary grounds weaken the federal fabric and are best avoided. A neater option is for the Finance Commission to recommend a special package for Andhra Pradesh. Since the Finance Commission is an apolitical, professional body enjoying a constitutional status, its recommendation will have gravitas.

States and divisions

But what is the case for Andhra Pradesh that the Finance Commission should consider?

All divisions of States into smaller units post 1956 have been done on political, administrative or geographical considerations. This has inevitably resulted in an uneven division of fiscal capacity. There are many indicators of the fiscal capacity of a State. One of the most robust is the State’s own revenue.

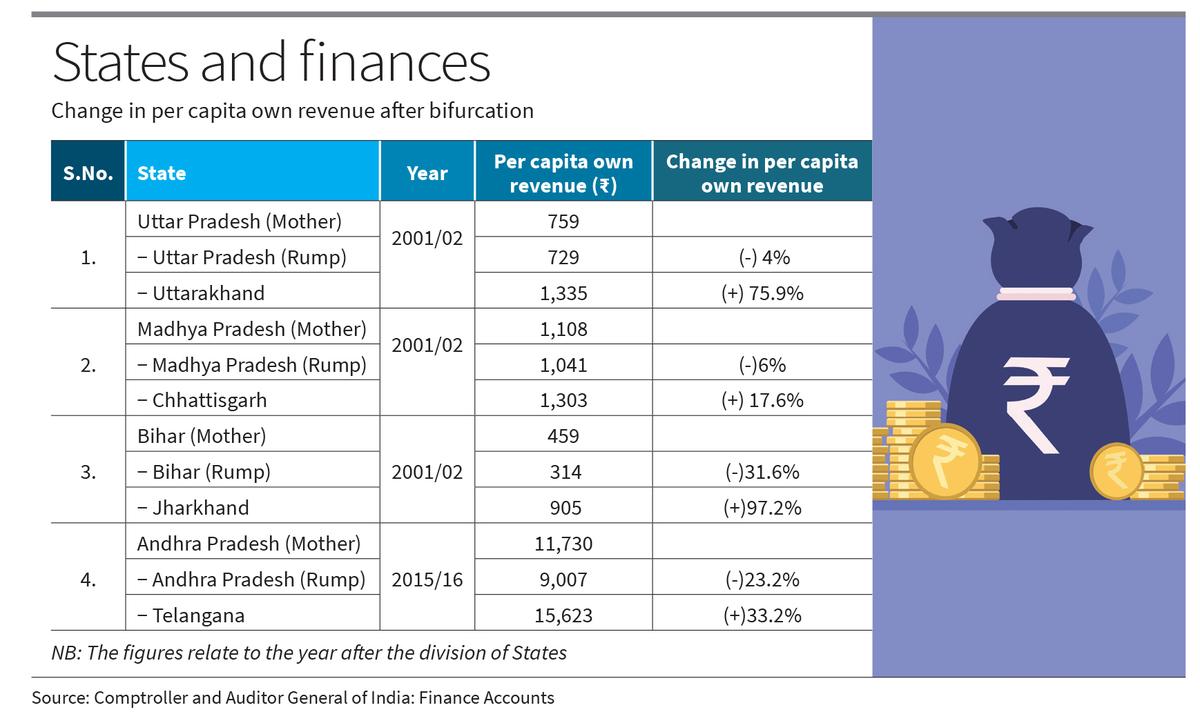

Consider State divisions that happened post 2000: Uttar Pradesh, Madhya Pradesh and Bihar were broken up in the year 2000, and Andhra Pradesh was divided in 2014. The table shows that in terms of per capita own revenue, in each of these cases, the carved out States, namely Uttarakhand, Chhattisgarh, Jharkhand and Telangana, gained at the expense of the rump States. But the loss in the case of Uttar Pradesh and Madhya Pradesh was relatively small when compared to that of Bihar and Andhra Pradesh.

One possible formula for a special package is that if the loss in fiscal capacity of a State on account of division is more than 10%, the Centre would give a special package spread over a limited period to compensate for the loss. On this formula, both Bihar and Andhra Pradesh will qualify for assistance.

The Finance Commission could of course consider other formulae that it thinks better capture the gain or loss in fiscal capacity. The important thing is that States such as Andhra Pradesh that have lost fiscal capacity on account of bifurcation are not abandoned to fend for themselves. It is incumbent on the Finance Commission, which is free to make recommendations to put our fiscal federalism on a sound footing, to evolve an objective, apolitical and formula-based solution to the problem.

Duvvuri Subbarao is former Finance Secretary to the Government of India and a former Governor, Reserve Bank of India

Published – May 30, 2025 12:16 am IST